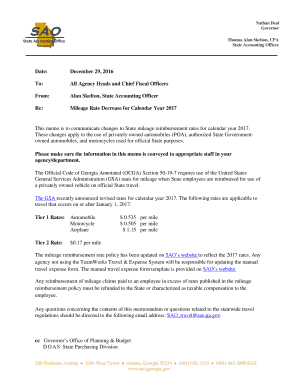

How do I write off 1099 expenses?Ĭan an independent contractor be reimbursed for expenses? But you can deduct business mileage as a business expense, which will subtract it from your taxable income. Is mileage that was reimbursed and included on 1099 counted as taxable income? Yes, it’s included in your taxable income, because that’s how it’s being reported to the IRS. Does mileage reimbursement get reported on 1099? … If you received reimbursement under a non-accountable plan, the reimbursement is considered taxable income and you can deduct the expenses. Usually you can’t write off business expenses if your employer has already reimbursed you. … Some employers that offer an expense allowance or reimburse expenses on employees’ paychecks, lump that reimbursement amount into an employee’s taxable income, figuring in social security, Medicare, and FUTA taxes. Unless you want to give money away to the IRS, expense reimbursements shouldn’t be taxed. Do you get taxed on expense reimbursements?

#Contractor mileage reimbursement professional

If a self-employed professional receives any reimbursement for vehicle use that applies for a tax deduction, the amount is not taxable on the self-employed person’s taxes and are deductible on the business’s taxes. Are reimbursed expenses considered income self-employed? … Payments to employees belong on form W-2, not Form 1099. Remember board member’s companion travel payments or reimbursements are considered income and should be reported on Form W-2.

Should reimbursements be paid through payroll?.Do you claim mileage reimbursement as income?.Do I have to report mileage reimbursement as income?.How much should I set aside for taxes 1099?.

Are reimbursed expenses considered income self-employed?.Do reimbursed travel expenses go on a 1099?.

0 kommentar(er)

0 kommentar(er)